Every Central Banker's Worst Fear Might be Right Around the Corner

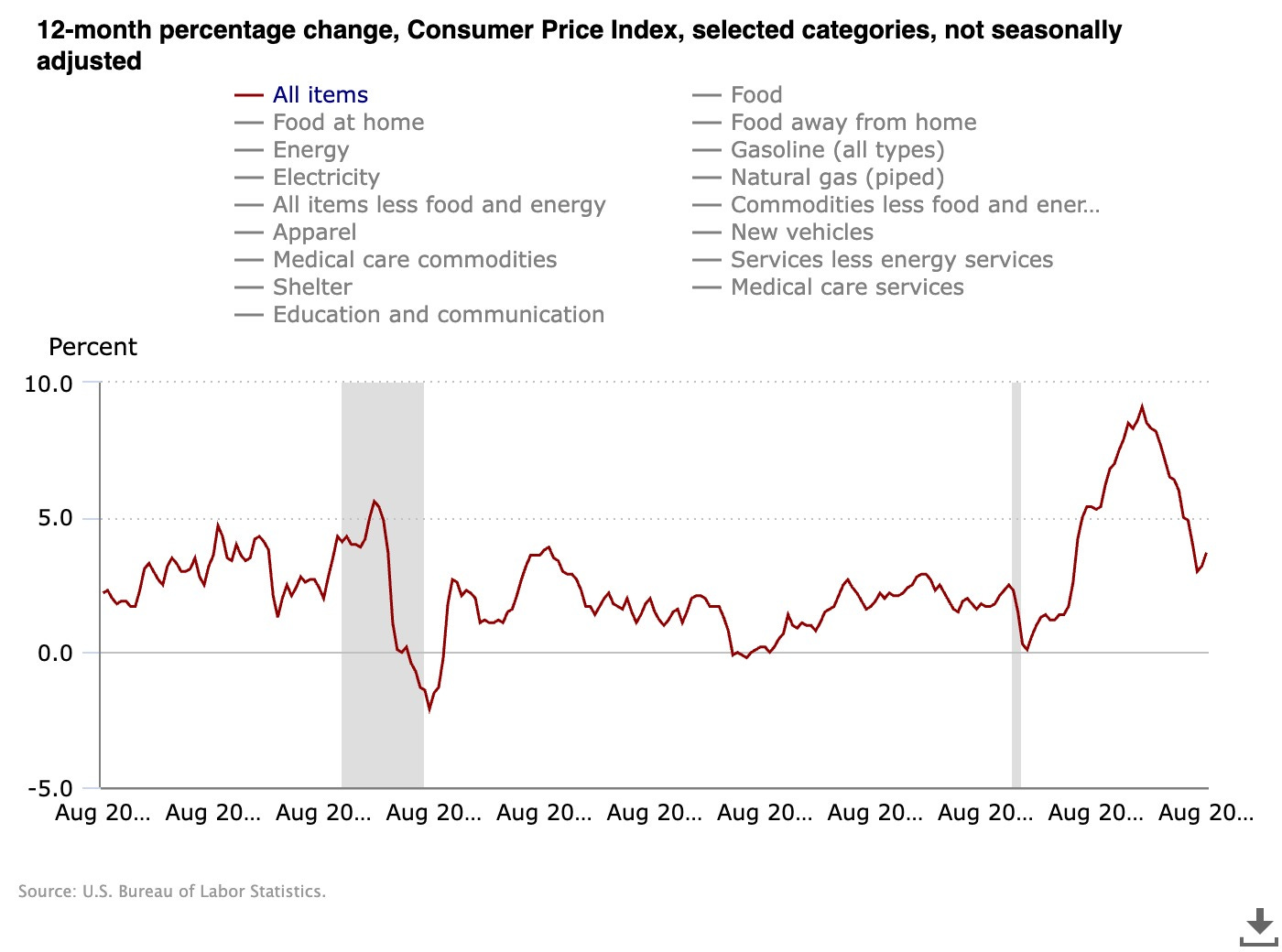

Inflation has been a thorn in the side of central bankers around the world. To combat inflation the US Federal Reserve has implemented the fastest interest rate hikes since the 1980’s. Despite CPI coming down from its peak of 9.1% in June 2022, inflation is beginning to pick back up. There are ominous signs that the Fed will face major headwinds on the inflation front over the next 6-12 months.

One of the biggest challenges facing central bankers is the geopolitical fallout and its impact on the global economy from the Ukraine/Russian war. Both Ukraine and Russia are powerhouse grain exporters to the world, especially to the so-called Global South. On July 17, 2023 Russia pulled out of the Black Sea Grain deal which was agreed upon in July 2022 which was brokered by Turkey.

However, since the deal expired the war has spilled out into the black sea which once again threatens global food prices. Ukraine is also becoming more sophisticated in its operations in the black sea which could be a nail in the coffin for food disinflation. Recently, Ukraine successfully attacked the local Russian naval headquarters and killed a high level officer according to the Ukrainian military.

To make matters worse for Jerome Powell and the Federal Reserve’s fight against inflation, Russia has been maneuvering around US Sanctions and has begun to tighten the screws on the energy market as oil marches toward $100 a barrel.

Source: Trading Economics

The US is getting no help from its frenemy Saudi Arabia who has cut oil production for the rest of 2023 which will mechanically raise energy prices for the remainder of the year. The Crown Prince and PM of Saudi Arabia; Mohammed bin Salman has no incentive to help the United States, especially with the sour relationship which has developed with President Joe Biden over the past few years… With the 2024 US presidential elections looming, MBS would like nothing more than to stick it to President Biden with persistently high energy prices to anger the American voter. And guess who else would like to anger the American voter to the point that they would replace Biden with a Republican administration less sympathetic to the Ukrainian fight against Russia? Vladimir Putin…

I can imagine that Jerome Powell and the Fed are watching these geopolitical events with bated breath. As my colleague Tynan Overstreet so eloquently pointed out in Rule #3: QT is Fleeting, but QE is Forever, the Fed is playing a game of chicken with quantitative tightening. At some point the Fed will have no choice but to turn the money machines back on because of the result of too much liquidity being sucked out of the system by QT or continue QT indefinitely and risk destroying the economy.

Another area of concern for the Fed is wage inflation. Rapid inflation is a problem for an economy because business cost remains sticky and it is much harder to bring inflation in line once wages have become a structural part of high business cost – i.e. the dreaded wage price spiral.

Ignoring the wage spike in 2020 which was due to lower wage workers losing employment while higher white collar workers kept their jobs which skewed the data. The dramatic changes in work culture, expectations and norms due to the pandemic has led to employees demand for higher wages. We can look at the numerous strikes throughout the country from the UAW strike against the big automakers, to pharmacists' fight against CVS as well as Hollywood writers and actors strike against the studio houses to name a few. The US economy has been impressively resilient so far but as the saying goes, everything is fine until it ain’t anymore…