The American Consumer is Under Pressure

With inflation on top of every economist’s and market participant’s mind, I got to thinking about what are some of the characteristics of high inflationary environments. This led me to one of my favorite books on the subject of inflation, The Great Wave: Price Revolutions and the Rhythm of History, written by David Hackett Fischer.

In his insightful book, Fischer’s research identifies four waves of inflationary periods which he tracks from the early twelfth century to today. To no surprise, one of the characteristics common across price revolutions is that the prices of goods significantly outpaces wages. Furthermore, in the later stages of price revolutions, real wages rapidly fall which lead to societal conflicts and bad things usually happen... Such as wars, famine, etc…

“As a consequence real wages fell, slowly at first, then with growing momentum. By the late thirteenth and early fourteenth centuries real wages were dropping at a rapid rate. In 1320 real wages in western Europe were 25 to 40 percent lower than they had been a century before. At the same time that real wages fell, rent and interest rose sharply.” ~ The Great Wave Author, David Hackett Fischer

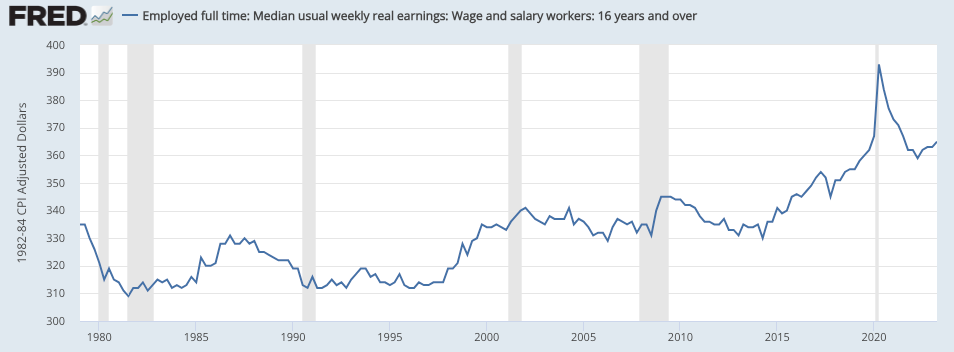

This led me to wonder what type of economic shape the American consumer was in and could I gain some insight on where we are at in this particular inflationary wave that Fischer has identified. So I first pulled up a chart of US real wages which measures the wages of American workers 16 years old and above, adjusted for inflation.

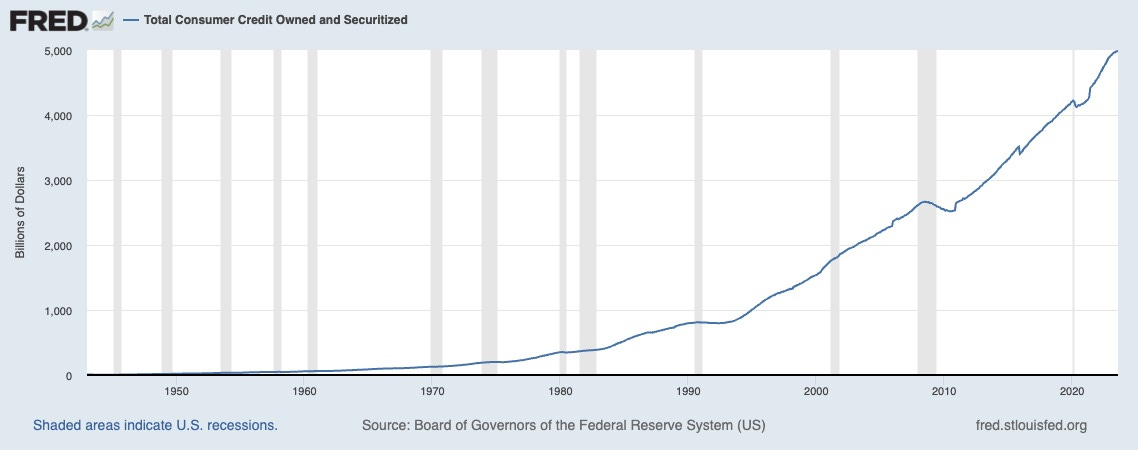

At first glance, the American consumer seems to be doing well. As the chart suggests, consumer wages have increased and outpaced inflation. Great for the consumer… Right? However when you take a look at consumer credit, the picture of the American consumer starts to look concerning…

Since the beginning of 2008 to present day, consumer credit has been up approximately 89% compared with 59% in terms of nominal wages for the American worker. It would seem that even though wages have risen, the indebtedness of the US consumer has increased even more!

This means the leverage ratio of the consumer has exploded. Coupled with high borrowing costs, making it difficult to roll over debt, the consumer is under enormous pressure to service its pile of debt. If the economy tips into a recession in 2024, it could turnout to be a hard landing.

If we dig further into the wage data an even more alarming trend appears. There is a marked difference between the way real wages have trended for different income levels. Particularly, wages for the bottom quintile of earners is actually down since 2008.

On the other hand, wages and salaries of the top quintile have done a much better job keeping up with inflation:

This inequality has led to a year of labor protests as workers demand higher wages to compensate for higher costs of living. As we have said before Inflation perpetuates class conflict. This is another theme of Fischer’s research: the rich always seem to suffer inflation better than the lowest classes, as returns to capital flourish at the later stages of every price revolution. Inevitably something has to give, whether it be war, famine, or pestilence and the process goes into reverse and real wages rise as prices stabilize. The transition from one economic regime to the other is often fraught with violence.