U.S. Economy: Bend but don't Break... Yet.

In honor of the start of football season in the US, I’m going to talk about a saying that is important to both financial practitioners and pro athletes: bend but don’t break.

In football, this saying usually refers to a situation when the defense has given up a lot of yardage but is still somehow keeping the other team out of the endzone. A great example of a bend but don’t break moment was in Super XLIX between the New England Patriots and the Seattle Seahawks. It’s the 4th quarter and the New England Patriots are up 28-24 over the Seattle Seahawks with 2:02 minutes left in the game.

Seattle started on the 20 yard line which was plenty of time for the great Russel Wilson and the high powered Seattle offense to march down the field for a comeback victory. Russell Wilson opens the drive with a 31 yard pass to Marshawn Lynch which puts Seattle on New England's 49 yard line. With 1:14 minutes left in the game, Russell Wilson threw a deep 33 yard pass to wide receiver Jermaine Kearse who made a circus catch to move the Seahawks within 5 yards of winning the Super Bowl with a 1:06 left to go in the game. However the Patriots defense hunkers down and eventually forced a Russell Wilson interception at the 1 yard line which will forever haunt Head Coach Pete Carroll for calling a passing play on the 1 yard line when you have one of the best running backs in the league at the time in Marshawn Lynch.

So far, Jerome Powell and the Federal Reserve have keeped the economy from breaking just like the Patriots defense did in the final minutes of Super Bowl XLIX. Although there were times over the past year were the US economy was bent but didn’ break such as when inflation peaked at 9.1% in June 2022 or in March 2023 during the banking crisis were we saw a string of failed banks such as Silvergate Bank, SVB, Signature Bank and First Republic all blow up.

Ostensibly, the U.S. economy has been surprisingly resilient in the face of hawkish headwinds from pesky inflation and high interest rates. Despite the uncertainty, there are no glaring signs of economic distress. However there are a few economic statistics that we are keeping our eye on in the second half of 2023 and they point to the American consumer and the banking system.

In early August, the Federal Reserve Bank of New York’s Center for Microeconomic Data issued a report on household debt and credit that raised eyebrows on the trading desk. Although the report was not overtly negative it did highlight potential troubles ahead for the U.S. economy in the second half of 2023.

Although household debt growth has slowed recently, total household debt has risen to an eye-popping $17.06 trillion:

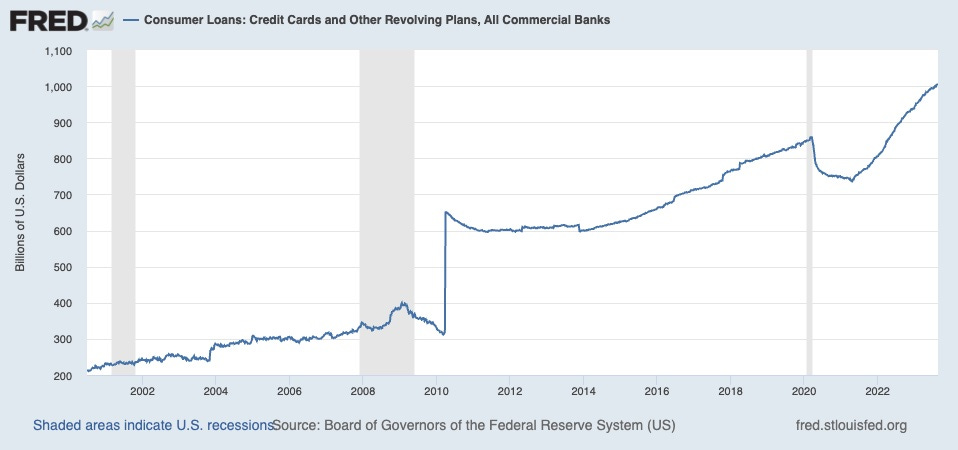

On the surface there is little change in total debt balance. However if we strip away the type of debt and zoom in on consumer credit card debt we see a spike in the data (see Consumer Loans chart below).

Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks

When we look at the delinquency data for all loans, leases and credit cards to consumers (see chart below) we can see a sharp upward trend which is worse than the Great Financial Crisis of 2008.

When we dig deeper into the report issued by The Federal Reserve Bank of New York’s Center for Microeconomic Data, we see a spike in two major categories of consumer debt which is credit card and auto loan debt. Delinquency in the credit card category is up 5.08% in Q2 2023 compared to 3.35% the same quarter of 2022. Furthermore, auto loan debt delinquency spiked to 2.41% in Q2 2023 compared to 1.81% in Q2 2022.

Although the U.S. consumer has been resilient so far, cracks are beginning to show in the data. High interest rates will put more pressure on the consumer’s borrowing cost. With credit card interest rates topping 20%, the interest maintenance alone amounts to over $200 billion / year.

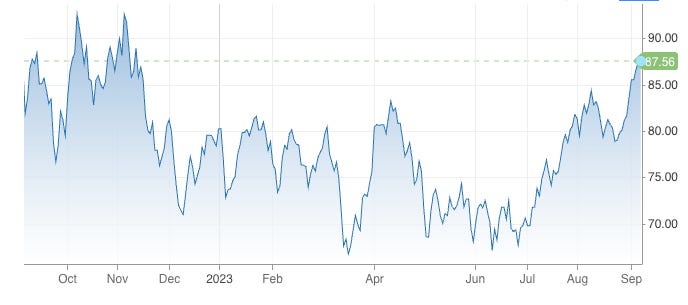

Furthermore, the war in Ukraine continues to rage on in Europe and will continue to put pressure on global food prices as Russia and Ukraine accounted for 10% and 3% of global wheat production on average over the past five years, respectively according to OECD. In addition, energy prices are beginning to creep back up towards $100 a barrel which was last reached at the onset of the Russian invasion of Ukraine.

WTI Crude Oil source: New York Mercantile Exchange

We are keeping a close eye on consumer data from both traditional and alternative data sources which could prove to be a “fault line” in the economy that could spread to broader economic trouble for instance a vulnerable banking sector.