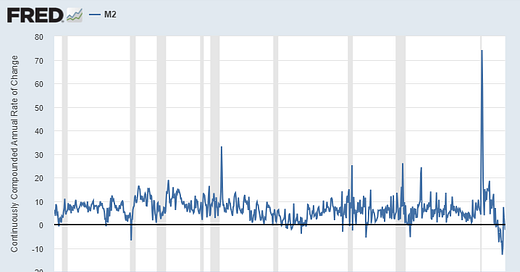

Since the passage of the Federal Reserve Act in December 1913, the money supply of the United States has never contracted as much as it has in 2023. Right before the banking crisis of 2023, the supply of broad money had contracted by a staggering 12.8% year on year:

Source: https://fred.stlouisfed.org/graph/?g=19lTi

For comparison in Feb 1970 the broad money supply contracted by ~6.7%. After that, during what is considered the worst inflationary episode prior to our own, the broad supply of money never contracted.

While the M2 series stops in 1959, we can use an older estimate of total money supply compiled by the NBER to extend it back to the beginnings of the Fed:

From this chart, we can see that the only two events that even come close to our own time occurred briefly in the middle of WW2, perhaps as a result of increased sales of war bonds, and again at the start of the Great Depression.

The March 2023 banking crisis temporarily paused money destruction, but QT has relentlessly pulled the money supply back below pre-crisis levels. With US 30 year bond yields streaking past 4.7% today, how much longer until something else breaks? And where? Perhaps with the US consumer…